IRS 1040-EZ 2017-2025 free printable template

Show details

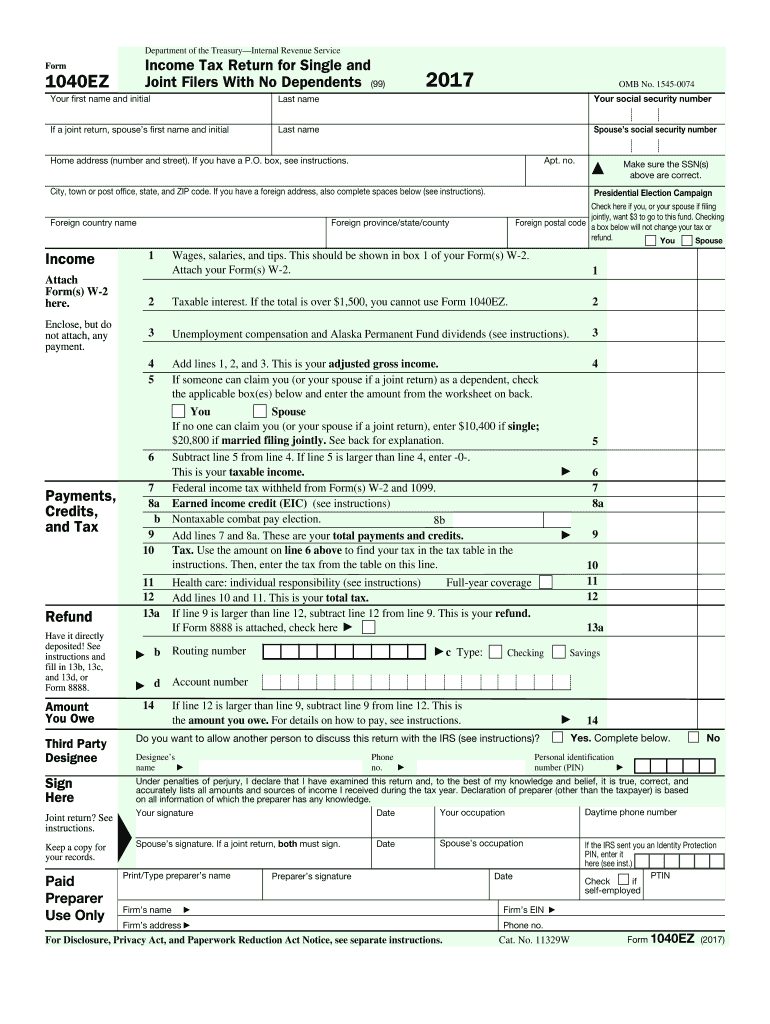

Cat. No. 11329W Form 1040EZ 2017 Page 2 Use this form Your filing status is single or married filing jointly. If you are planning to use Form 1040EZ for a child who received Alaska Permanent Fund dividends see instructions. If the total is over 1 500 you cannot use Form 1040EZ. Unemployment compensation and Alaska Permanent Fund dividends see instructions. But if you earned tips including allocated tips that are not included in box 5 and box 7 of your Form W-2 you may not be able to use Form...

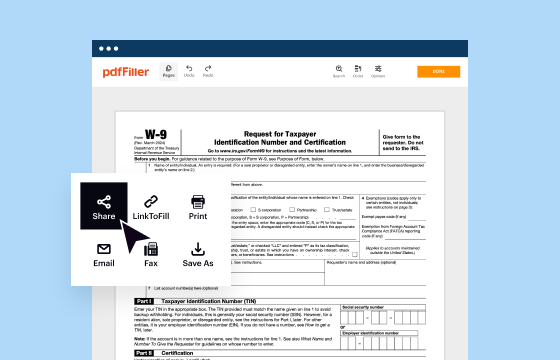

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1040-EZ

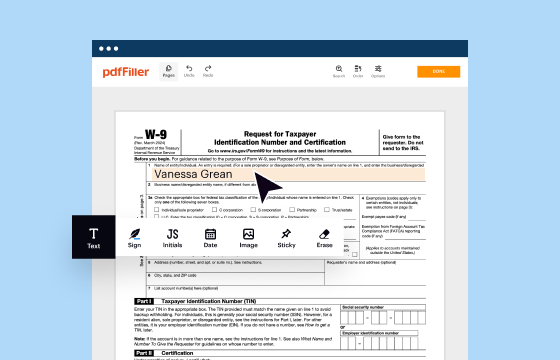

Step-by-Step Instructions for Modifying Your Form

Guidelines for Filling Out the IRS 1040-EZ

Understanding and Utilizing IRS 1040-EZ

The IRS 1040-EZ form is a streamlined tax return specifically designed for ease of use by qualifying taxpayers. This form allows filers with straightforward financial situations to report their income and calculate their tax obligations efficiently. Understanding its nuances is crucial for maximizing deductions and ensuring compliance with federal tax laws. Below, we provide a comprehensive overview of the 1040-EZ format, its purpose, recent updates, and critical details necessary for completion.

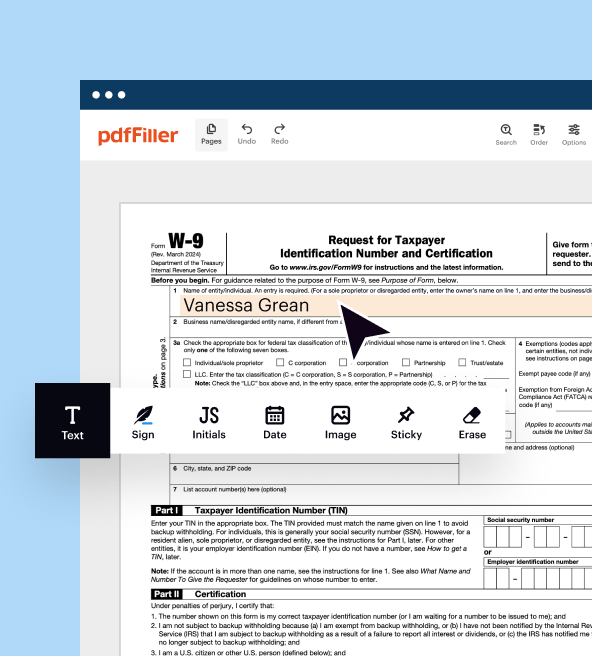

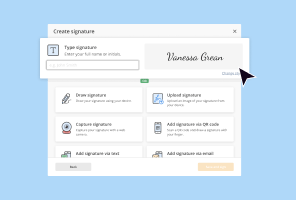

Step-by-Step Instructions for Modifying Your Form

Editing your IRS 1040-EZ requires careful attention to detail to avoid errors that could lead to penalties. Follow these steps to ensure your form is completed correctly:

01

Gather all necessary financial documents, including your W-2, interest statements, and any other relevant income information.

02

Review the income eligibility criteria to confirm you qualify to use 1040-EZ.

03

Open your completed IRS 1040-EZ form in a compatible editing tool.

04

Update personal information if there are any changes, including your name, address, or filing status.

05

Enter your total income and any applicable claims for the tax credits directly into the designated fields.

06

Double-check all entered figures for accuracy and correctness, particularly the sums and calculations.

07

Save and review the finalized document before submitting.

Guidelines for Filling Out the IRS 1040-EZ

Completing the IRS 1040-EZ form involves specific instructions that streamline the filing process:

01

Provide personal details including name, address, and Social Security number at the top of the form.

02

Report your total income on line 1; this includes wages, salaries, tips, and taxable interest under $1,500.

03

Complete the adjustments section if you qualify for any standard deductions such as the Earned Income Tax Credit.

04

Fill in the applicable tax amounts based on IRS tax tables to determine final obligations.

05

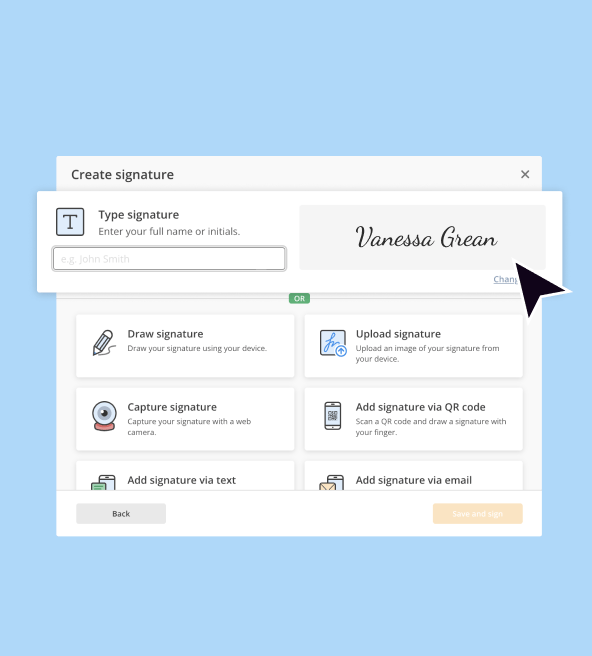

Sign and date the form before submission to validate your entries.

Show more

Show less

Recent Updates and Revisions to the IRS 1040-EZ

Recent Updates and Revisions to the IRS 1040-EZ

As tax regulations evolve, it's important to stay current on any changes affecting the 1040-EZ form. In recent filings, notable updates include:

01

The income threshold for qualifying filers has increased, allowing more taxpayers to benefit from simplified filing.

02

Adjustments to the maximum adjusted gross income (AGI) limits to reflect changes in personal exemptions, increasing accessibility.

03

New guidelines for reporting health care coverage or exemptions, which must be noted even when filing the simpler 1040-EZ form.

Essential Insights into the IRS 1040-EZ

Defining IRS 1040-EZ

The Intent Behind IRS 1040-EZ

Target Audience for IRS 1040-EZ Completion

Conditions for Exemption from Completing IRS 1040-EZ

Core Components of IRS 1040-EZ

Deadline for Submitting IRS 1040-EZ

Contrasting IRS 1040-EZ with Similar Tax Forms

Tax Transactions Covered by IRS 1040-EZ

Copies Required for IRS 1040-EZ Submission

Understanding Penalties for Non-Compliance with IRS 1040-EZ

Information Needed for Filing IRS 1040-EZ

Complementary Forms to Include with IRS 1040-EZ

Where to Submit Your IRS 1040-EZ

Essential Insights into the IRS 1040-EZ

Defining IRS 1040-EZ

The IRS 1040-EZ is one of the simplest tax forms meant for individuals with basic tax reporting needs. It is tailored for single or married filers without dependents, featuring a simplified structure that allows for the easy calculation of federal income tax.

The Intent Behind IRS 1040-EZ

This form is designed to facilitate tax filing for eligible individuals who may not have complex financial situations. The intent is to ease the burden of tax preparation while ensuring compliance with federal tax responsibilities.

Target Audience for IRS 1040-EZ Completion

The 1040-EZ is intended for:

01

Single or married taxpayers filing jointly with an AGI of less than $100,000.

02

Individuals who do not claim any dependents.

03

Taxpayers whose only source of income is from wages, salaries, or limited taxable interest.

Conditions for Exemption from Completing IRS 1040-EZ

Exemptions from filing the 1040-EZ apply under certain conditions:

01

If your taxable income exceeds $100,000.

02

When the taxpayer is married but filing separately.

03

If you or your spouse claims dependents, you need to use IRS Form 1040 instead.

Core Components of IRS 1040-EZ

The 1040-EZ consists of several key sections, including:

01

Personal Information: Name, address, filing status.

02

Income Reporting: Total income from W-2 forms or taxable interest.

03

Calculating Adjusted Gross Income: Deductions for personal exemptions.

04

Tax and Credits: Application of standard deductions and tax credits.

05

Signature Area: Validation of provided information by the taxpayer.

Deadline for Submitting IRS 1040-EZ

Taxpayers must file the 1040-EZ by April 15 each year, unless this date falls on a weekend or federal holiday, shifting the deadline to the next business day. It is critical to adhere to this schedule to avoid penalties.

Contrasting IRS 1040-EZ with Similar Tax Forms

When comparing the IRS 1040-EZ with other forms:

01

The IRS Form 1040 is for more complex tax situations, including itemized deductions and various credits.

02

The IRS 1040A can accommodate those who have certain adjustments to income but still wish for a straightforward filing process.

Tax Transactions Covered by IRS 1040-EZ

The IRS 1040-EZ encompasses simple income sources, including:

01

Employment income as listed on a W-2 form.

02

Taxable interest amounts less than $1,500.

Copies Required for IRS 1040-EZ Submission

Typically, only one copy of the IRS 1040-EZ is required for filing. However, individuals should retain copies for their records in case of future reference or audit.

Understanding Penalties for Non-Compliance with IRS 1040-EZ

Failure to submit the 1040-EZ by the deadline can result in several penalties, including:

01

Late filing penalties: Generally 5% of the unpaid tax amount for each month unpaid, up to 25% maximum.

02

Potential interest on unpaid tax balances, accruing monthly until the balance is paid.

03

Additional penalties for failing to report income, which could lead to criminal charges in severe cases of tax evasion.

Information Needed for Filing IRS 1040-EZ

To complete your 1040-EZ efficiently, gather:

01

W-2 forms from your employer.

02

Records of any taxable interest received.

03

Social Security number for each individual listed on the form.

Complementary Forms to Include with IRS 1040-EZ

When filing the 1040-EZ, additional forms may be required depending on individual circumstances, such as:

01

Form 8862, if applicable for the Earned Income Tax Credit.

02

Form 8888 for direct deposit of refunds with multiple accounts.

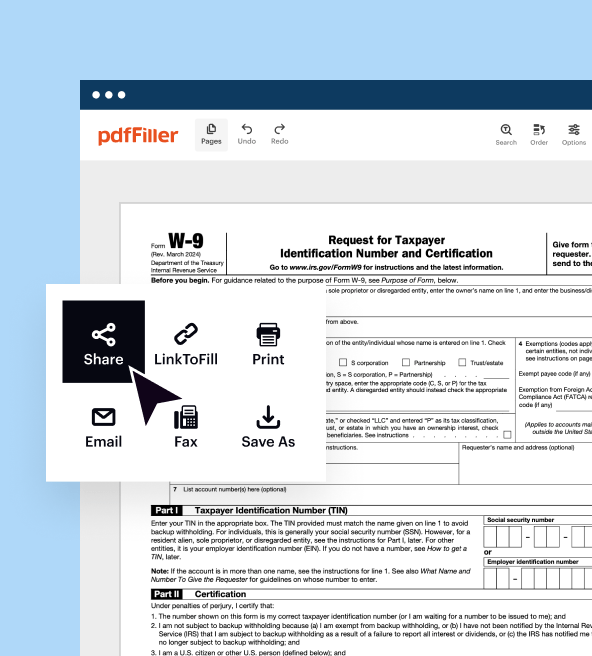

Where to Submit Your IRS 1040-EZ

Mail your completed IRS 1040-EZ to the address specified in the form instructions, appropriate to your state of residence. Alternatively, consider e-filing for expedited processing and immediate confirmation of receipt.

Understanding the IRS 1040-EZ and adhering to the requirements not only simplifies your tax filing process but minimizes the risk of complications down the line. Ensure you gather all necessary documentation, adhere to deadlines, and keep yourself informed of any updates or changes to the form and its regulations. For further assistance or to begin your filing process, reach out for help today.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Learning a lot thanks for the info an help

So far, so good. I don't like that it seems to lose its connection frequently and I have lost data a time or two but that may be a function of where/what I work on. Otherwise, fair deal for the price.

Try Risk Free